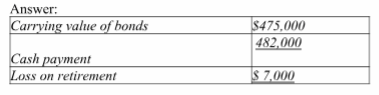

Mandarin Company has 9%, 20-year bonds outstanding with a par value of $500,000 and a carrying value of $475,000. The company calls the bonds at $482,000. Calculate the gain or loss on the retirement of these bonds.

What will be an ideal response?

You might also like to view...

The costs of materials and labor that do not enter directly into the finished product are classified as factory overhead

Indicate whether the statement is true or false

Fact Pattern 28-2BRico signs a lease on behalf of Start-Up Games, Inc., with Tower Office Suites. As part of the lease, Rico signs a document titled "GUARANTY," which states that it is "an absolute guaranty" of the lease's performance.Refer to Fact Pattern 28-2B. If Start-Up stops paying the rent, it is most likely that liability or loss for the unpaid amount will rest with

A. no one. B. Rico and Start-Up. C. Tower Office Suites. D. the other tenants on the same property.

Rogue Recreation, Inc has normally distributed returns with an expected return of 15% and a

standard deviation of 5%, while Lake Tours, Inc has normally distributed returns with an expected return of 15% and a standard deviation of 15%. Which of the following is true? A) Rogue Rec is likely to experience returns larger than those of Lake Tours. B) Rational investors will prefer Lake Tours, Inc. over Rogue Recreation, Inc. C) Lake Tours is more likely to have negative returns than Rogue Rec. D) Lake Tours' investors are not being adequately compensated for relevant risk.

In order to determine if the case she was hearing broke the law, Judge Jane referred to prior rulings on the same subject. In other words, the judge is relying on precedent to make her decision.

Answer the following statement true (T) or false (F)