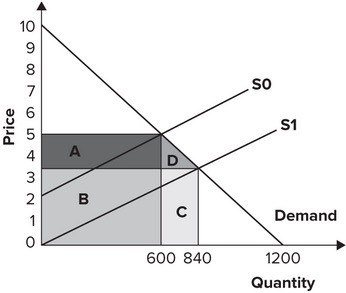

Refer to the graph shown. Initially, the market is in equilibrium where the demand curve intersects S0. In the initial equilibrium, producer surplus is equal to:

A. 1,800.

B. 4,500.

C. 6,000.

D. 900.

Answer: D

You might also like to view...

Claudia's Copy Shop is deciding which 3-D printer to purchase, and it only has room for one printer

It can purchase the "Mini-Me" small-object printer, which would generate benefits of $50,000 at a cost of $5,000, or it can purchase the "Gargantuan" large-object printer which would generate benefits of $250,000 at a cost of $25,000. Based on these numbers, Claudia's Copy Shop should purchase A) the "Mini-Me" printer. B) the "Gargantuan" printer. C) either printer, since the cost of each is exactly 10 percent of the benefit from each. D) neither printer, since the cost of each is too high for a 3-D printer.

The GDP deflator is not a fixed-quantity price index, but the CPI is. What is the significance of this fact?

A) The GDP deflator does not include enough items in its market basket. B) A base year cannot be defined for the GDP deflator. C) The GDP deflator reflects not only changes in prices, but also changes in consumption patterns as consumers substitute between goods. D) The GDP deflator overstates the true rate of inflation, whereas the CPI understates it.

Last year due to the increased rainfall there was a plentiful supply of blueberries which caused their price to drop. Bakeries regularly produce and sell blueberry pie. Considering the market for blueberry pies, what factor of supply has been affected, and what was the overall effect on the supply?

A. The price of an input has been affected; supply will increase. B. The price of an input has been affected; supply will decrease. C. The new technology has been affected; supply will increase. D. The number of sellers has been affected; supply will increase.

The immediate effect of a bank's purchase of U.S. government securities from the Fed is a(n): a. decrease in the bank's assets

b. increase in the bank's assets. c. decrease in the Fed's assets. d. increase in the Fed's assets. e. decrease in both the bank's and the Fed's assets.