Suppose the government of Portico wants to discourage the consumption of tobacco among its citizens. Which of the following strategies would it adopt?

a. Taxing the buyers with relatively elastic demand

b. Taxing the buyers with relatively inelastic demand

c. Taxing the sellers with relatively inelastic supply

d. Taxing the buyers with perfectly inelastic demand

a

You might also like to view...

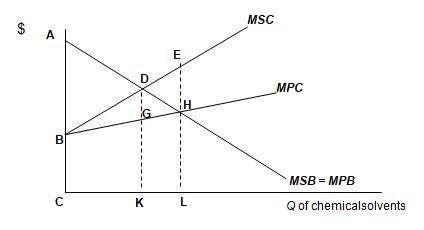

The loss of profit to the chemical solvent manufacturer from changing its output from QC to QE is

Consider the following graph of the market for chemical solvents, production of which damages a waterbody used for recreation.

a. DGH b. DEH c. DEHG d. EH

Which of the following is a benefit of affirmative action programs?

A) They ensure that qualified minorities are not being passed over in favor of less-qualified applicants. B) They ensure a fundamental sense of fairness in hiring and promotion. C) They can provide a means and an incentive for members of historically underperforming groups to intentionally change their characteristics, such as investing in education and acquiring experience. D) All of the above are benefits of affirmative action programs.

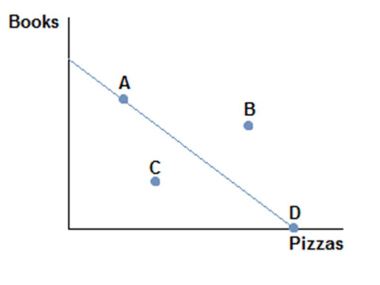

Consider the production possibilities frontier displayed in the figure shown. Which of the following statements is currently true?

A. Producing at point A is the best choice, because some of both items are made.

B. Producing at point D would be inefficient, since no books would be produced.

C. Producing at point C is the best choice, because it's closest to the middle.

D. Producing at point B is impossible.

Inflationary tendencies and even hyperinflation in many Latin American countries have been exacerbated by the tendency of governments to

A) tax too heavily. B) regulate too heavily. C) print money to finance policies to stimulate the economy. D) keep out foreign competition.