A firm is considering investing $0.9M in a typical industrial manufacturing application with a three-year production planning cycle under a forecasted market price environment. A simple three-period project pro forma cash flow sheet for this project is shown below:

In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

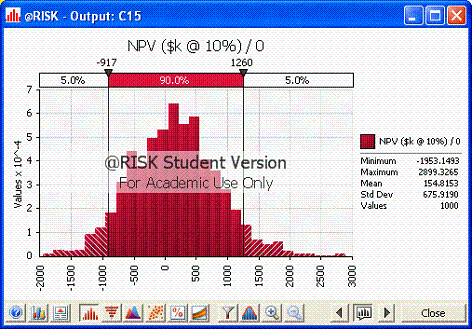

Using the information from the pro forma, discuss what the distribution of the NPV looks like.

What will be an ideal response?

The distribution is nearly symmetric, with a large range, including many negative values.

?

?

You might also like to view...

Using simple language in persuasive messages usually increases your credibility with a skeptical audience

Indicate whether the statement is true or false.

Which of the following agencies is responsible for protecting the president of the United States and other federal dignitaries?

a. CIA b. NCIC c. FBI d. Secret Service

Total fixed costs remain constant within a defined time period or range of activity

Indicate whether the statement is true or false

If a firm uses variable costing, fixed manufacturing overhead will be included

a. only on the balance sheet. b. only on the income statement. c. on both the balance sheet and income statement. d. on neither the balance sheet nor income statement.