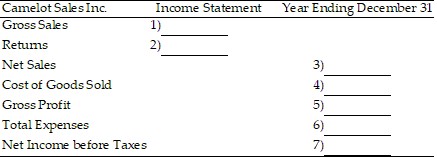

Complete the income statement. Camelot Sales Inc. had gross sales of $2,659,000 with returns of $59,700. The inventory on January 1 was $570,000. During the year $1,062,000 worth of goods was purchased with freight of $5,600. The inventory on December 31 was $519,000. Wages and salaries were $82,600, rent was $14,500, advertising was $17,400, utilities were $5,200, business taxes totaled $9,000, and miscellaneous expenses were $6,200.

A. 1) $2,659,000, 2) $59,700, 3) $2,599,300, 4) $1,118,600, 5) $1,480,700,

B. 1) $2,659,000, 2) $59,700, 3) $2,718,700, 4) $1,118,600, 5) $1,600,100,

C. 1) $2,659,000, 2) $59,700, 3) $2,599,300, 4) $1,107,400, 5) $1,491,900,

D. 1) $2,659,000, 2) $59,700, 3) $2,599,300, 4) $1,118,600, 5) $1,480,700,

Answer: D

You might also like to view...

Perform the indicated operation.Let B =  . Find -3B.

. Find -3B.

A.

B.

C.

D.

Solve.In a track meet, Ashley runs 600 meters in 82.3 seconds. What was her average speed in meters per second? (Round to the nearest tenth.)

A. 1.4 m/s B. 7.3 m/s C. 0.7 m/s D. 0.1 m/s

Determine the tax rate. Round to the nearest cent or nearest hundredth.Assessed property value: $40,356,000Expenses to be funded by property tax: $2,633,000Tax per amount of assessed value: mill

A. 6.52 mills B. 65.24 mills C. 15.33 mills D. 1.53 mills

List the elements in the sample space of the experiment.A box contains 3 blue cards numbered 1 through 3, and 4 green cards numbered 1 through 4. List the sample space of picking a blue card followed by a green card.

A. {7} B. {(1, 1), (1, 2), (1, 3), (1, 4), (2, 1), (2, 2), (2, 3), (2, 4), (3, 1), (3, 2), (3, 3), (3, 4)} C. {12} D. {(1, 1), (1, 2), (1, 3), (2, 1), (2, 2), (2, 3), (3, 1), (3, 2), (3, 3), (4, 1), (4, 2), (4, 3)}