Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period rises, and reserve-related (central bank) transactions becomes more positive (or less negative).

b. The quantity of real loanable funds per time period rises, and reserve-related (central bank) transactions remain the same.

c. There is not enough information to determine what happens to these two macroeconomic variables.

d. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions remain the same.

e. The quantity of real loanable funds per time period and reserve-related (central bank) transactions remain the same.

.D

You might also like to view...

If the current allocation of resources in the market for wallpaper is efficient, then it must be the case that

a. producer surplus equals consumer surplus in the market for wallpaper. b. the market for wallpaper is in equilibrium. c. on the last unit of wallpaper that was produced and sold, the value to buyers exceeded the cost to sellers. d. All of the above are correct.

Which of the following is most important if a country wants to move from a low-income to a high-income status?

What will be an ideal response?

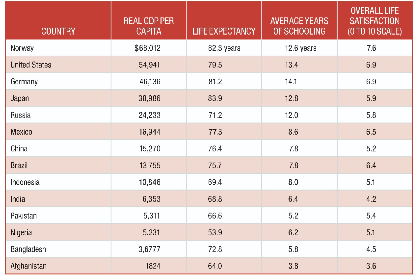

Which country best reinforces the idea that the higher the real GDP per capita is, the more satisfied people are in that country?

a. India

b. China

c. Russia

d. Norway

Suppose the demand for good x is ln Qxd = 21 ? 0.8 ln Px ? 1.6 ln Py + 6.2 ln M + 0.4 ln Ax. Then we know that the own price elasticity for good x is:

A. inelastic. B. elastic. C. unitary. D. It cannot be calculated from the existing information.