Some employers promise to contribute a certain amount to the pension plan each period for each employee, usually based on an employee's salary, without specifying the benefits the employee will receive during retirement. The amounts employees eventually receive depend on the investment performance of the pension plan. Such plans are referred to as

a. defined benefit pension plans.

b. defined contribution pension plans.

c. deferred compensation plans.

d. 529 Plans.

e. individual retirement accounts.

B

You might also like to view...

A company fails to record one storeroom full of inventory in its year-end inventory records. As a result, this will cause:

a. an overstatement of cost of goods sold for the current year. b. an overstatement of inventory on the year-end balance sheet. c. an overstatement of retained earnings at the end of the year. d. an understatement of gross profit in the following year.

If Enrique leaves the money in the account until he is 68, by approximately what amount would the balance increase between his 62nd and 68th years?

As a teenager, Enrique learned a valuable lesson from his dad, who told him to invest $1,000 at 8 percent interest at age 20 and leave the money alone until age 65. Enrique's dad knew that one strategy used by wealthy people is to exercise self-discipline and never touch a long-term savings plan. Enrique is happy to apply his dad's advice. A) $14,872 B) $108,569 C) $8,291 D) $35,551

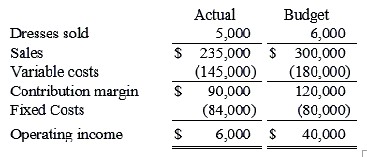

Danner Fashions sells a line of women's dresses. Danner's performance report for November is shown below: (CMA adapted)The company uses a flexible budget to analyze its performance and to measure the effect on operating income of the various factors affecting the difference between budgeted and actual operating income.  The sales price variance for November is:

The sales price variance for November is:

A. $18,000 unfavorable. B. $20,000 unfavorable. C. $30,000 unfavorable. D. $15,000 unfavorable.

Distinguish between tacit and explicit knowledge

What will be an ideal response?