Selected data from Carson Corporation's financial statements for the year ended December 31, Year 2 are as follows. Current ratio 1.4 Quick ratio 0.86 Current liabilities $450,000 Accounts receivable turnover 6.0 Merchandise inventory turnover 4.0 Rate of return on assets 6.5% Selected Account Balances at December 31, Year 1: Accounts receivable $355,000 Merchandise inventory 190,000 Year 2

Operations Sales $1,241,000 Cost of goods sold 800,000 Assuming that prepaid expenses are immaterial, ending merchandise inventory at December 31, Year 2 is

a. $180,000

b. $210,000

c. $220,000

d. $240,000

e. $260,000

B

You might also like to view...

Which of the following formats provides more than two possible choices?

A) the multivariate format B) the tri-dual format C) the multiple-choice category format D) the n-way format E) none of the above: no question has more than two possible choices

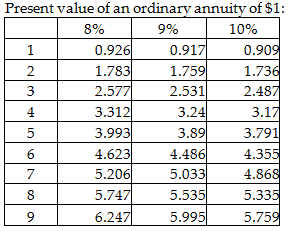

Caldwell Corporation is considering an investment proposal that will require an initial outlay of $804,000 and would yield yearly cash inflows of $200,000 for nine years. The company uses a discount rate of 10%. What is the NPV of the investment?

A) $350,000

B) $402,000

C) $347,800

D) $251,667

Based on the information in Table 4-1, assuming that no preferred dividends were paid, the return

on common equity is A) 55.15%. B) 17.56%. C) 38.83%. D) 44.86%.

The Pawtucket Brewery uses the residual dividend model to set its dividends. Selected financial information for Pawtucket is provided in the table below. What is Pawtucket's dividend per share?

Selected Financial Information Pawtucket Brewery Net income $75 million Investments $110.25 million Equity capital structure weight 0.75 Shares Outstanding 42.5 million A) -$0.18 B) $0 C) $0.18 D) $0.25 E) $0.36