The case of New Zealand, described in the text, draws what technical conclusion regarding the country's international debt position?

What will be an ideal response?

Fundamentally, the question is whether or not a country can sustain a current account deficit indefinitely. The conclusion depends upon the country's future prospects. If net exports are expected to rise at a rate sufficient to counteract the effects of debt (including interest payments) over the relevant time period, than deficits could go on for an extended period.

You might also like to view...

Larry was accepted at three different graduate schools, and must choose one. Elite U costs $50,000 per year and did not offer Larry any financial aid. Larry values attending Elite U at $60,000 per year. State College costs $30,000 per year, and offered Larry an annual $10,000 scholarship. Larry values attending State College at $40,000 per year. NoName U costs $20,000 per year, and offered Larry a full $20,000 annual scholarship. Larry values attending NoName at $15,000 per year. Larry's opportunity cost of attending State College is:

A. $30,000 B. $35,000 C. $20,000 D. $15,000

Comparative advantage and trade allow nations to specialize in the production of a larger number of different goods.

a. true b. false

According to the infant industry argument for trade protectionism:

A. trade barriers must be used to protect domestic workers. B. new industries need to be shielded from competition in the early stages of learning by doing. C. tariffs imposed to aid new industries should never be removed. D. new industries are capable of competing with established rivals.

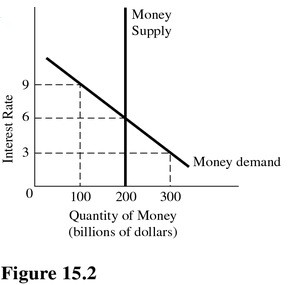

In Figure 15.2, the equilibrium rate of interest

In Figure 15.2, the equilibrium rate of interest

A. Is 9 percent. B. Is 6 percent. C. Is 3 percent. D. Cannot be determined from this figure.