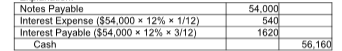

A $54,000, four-month, 12% note payable was issued on October 1, 2018. Which of the following would be included in the journal entry required on the note's maturity date by the borrower? (Do not round any intermediate calculations, and round your final answer to the nearest dollar.)

A) a credit to Note payable for $56,160

B) a credit to Cash for $54,000

C) a debit to Interest expense for $540

D) a debit to Interest payable for $540

C) a debit to Interest expense for $540

You might also like to view...

The person who acts as both sender and receiver of messages is called the

A) transceiver B) decoder C) encoder D) messenger

State and local politicians tend to apply new and increased taxes to taxpayers who are nonresident visitors to the jurisdiction, such as a tax on auto rentals and hotel stays, because the taxpayer cannot vote to reelect (or oust) the lawmaker.

Answer the following statement true (T) or false (F)

A firm can lose all rights to a brand name if the name becomes a common descriptive term for that kind of product.

Answer the following statement true (T) or false (F)

The staffing management plan addresses all of the following except:

a. how to identify internal and external human resources for the project. b. how to create RACI charts. c. how to handle timing issues in building, developing, and releasing the project team. d. how to determine the availability of human resources for the project