Ria's Doll Company has an outstanding preferred issue of stock with a par value of $100 and an annual dividend of 10 percent (of par). Similar risk preferred stocks are yielding an 11.5 percent annual rate of return

(a) What is the current value of the outstanding preferred stock?

(b) What will happen to price as the risk-free rate increases? Explain.

(a) Current value of the outstanding preferred stock = $100 × 0.10 / 0.115 = $86.96

(b) As the risk-free rate increases, the required rate of return will increase and the price will drop.

You might also like to view...

________ can enable one to improve marginal probabilities of the occurrence of an event by gathering additional information

Fill in the blank with correct word.

Gain-sharing plans do not use a historical standard to set productivity standards since environmental conditions can change quickly.

Answer the following statement true (T) or false (F)

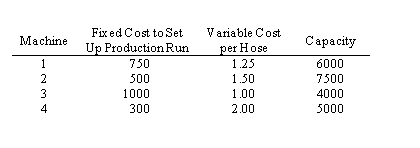

The company wants to minimize total cost. Give the objective function

Westfall Company has a contract to produce 10,000 garden hoses for a large discount chain. Westfall has four different machines that can produce this kind of hose. Because these machines are from different manufacturers and use differing technologies, their specifications are not the same.

Leadership teams are also known as quality councils

a. True b. False Indicate whether the statement is true or false