Suppose there is a simple tax system that says you pay 10% for income up to $10,000, 25% for income between $10,000 and $50,000, and 35% for all income above $50,000. Mr. Campbell has income of $72,000. Mrs. Campbell has income of $55,000.

(A) What is Mr. Campbell's individual tax liability? Mrs. Campbell'?

(B) What is their liability if they file a joint return?

(C) Is there a marriage penalty? If so, how much is

(A) Mr. Campbell: [(10,000 * 0.10) + (40,000 * 0.25) + (22,000 * 0.35)] = $18,700.

Mrs. Campbell: [(10,000 * 0.10) + (40,000 * 0.25) + (5,000 * 0.35)] = $12,750.

Total tax if filed separately = 18,700 + 12,750 = $31,450.

(B) Jointly: [(10,000 * 0.10) + (40,000 * 0.25) + (77,000 * 0.35)] = $37,950.

(C) Yes, the difference is $37,950 - $31,450 = $6,500.

You might also like to view...

A high-wage country cannot afford free trade with a low-wage country. The high- wage country will either be undersold or its workers will be forced to accept lower living standards

a. True b. False

According to the Texas Transportation Institute, the typical U.S. commuter wastes approximately how much time per year due to traffic congestion?

A. 47 hours B. 22 hours C. 42 hours D. 96 hours

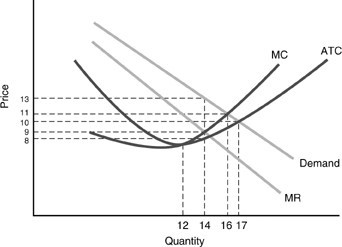

In the above figure, what is total cost at the profit-maximizing point?

In the above figure, what is total cost at the profit-maximizing point?

A. $182 B. $126 C. $170 D. $112

Over time, the general movement in the United States has been toward

A. relatively more free trade. B. higher tariffs and stricter import quotas. C. managed trade. D. complete elimination of tariffs, import quotas, and export subsidies.