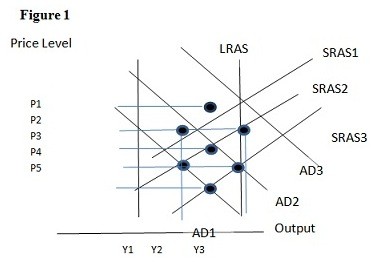

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the long run would be:

A. P2 and Y2.

B. P1 and Y2.

C. P4 and Y2.

D. P1 and Y1.

Answer: B

You might also like to view...

What reasons can you suggest for arguing that the federal government, unlike individuals, need never run a surplus budget?

The real interest rate:

a. Is always lower than the nominal interest rate. b. Is strongly affected by expected inflation. c. Equals the nominal interest rate plus the expected inflation. d. Is determined by lenders solely. e. Reflects a nation's time value of money.

An increase in the U.S. price level causes a

A. movement down the U.S. aggregate demand curve. B. shift of the U.S. aggregate demand curve to the right. C. movement up the U.S. aggregate demand curve. D. shift of the U.S. aggregate demand curve to the left.

Refer to the information provided in Table 14.2 below to answer the question that follows. Table 14.2B's Strategy ?AdvertiseDon't Advertise??A's profit $100 millionA's profit $200 million?AdvertiseB's profit $100 millionB's profit $50 millionA's Strategy????Don'tA's profit $50 millionA's profit $75 million?AdvertiseB's profit $200 millionB's profit $75 millionRefer to Table 14.2. Firm A?s dominant strategy is

A. to advertise. B. dependent on what Firm B does. C. to not advertise. D. indeterminate from this information, as no information is provided on Firm A?s risk preference.