Local property taxes are a

A. Progressive tax because as income increases people tend to buy more expensive houses.

B. Proportional tax because properties are taxed at the same rate regardless of the value of the home.

C. Regressive tax because poorer people spend a larger portion of their income on property taxes.

D. Progressive tax because the total tax on housing increases as the price of the house increases.

Answer: C

You might also like to view...

In the Keynesian framework, as long as output is ________ the equilibrium level, unplanned inventory investment will remain ________, firms will continue to raise production, and output will continue to rise

A) below; negative B) above; negative C) below; positive D) above; positive

The end of racial preferences in college admissions has had no noticeable effect on minority enrollments

Indicate whether the statement is true or false

Which of the following statements best describes the U.S. labor force since World War II?

a. Total employment grew, but the labor force participation rate fell. b. Total employment grew, and so did the labor force participation rate. c. Total employment grew, but the labor force participation rate remained unchanged. d. Total employment remained constant, but the labor force participation rate fell. e. Total employment remained constant, but the labor force participation rate rose.

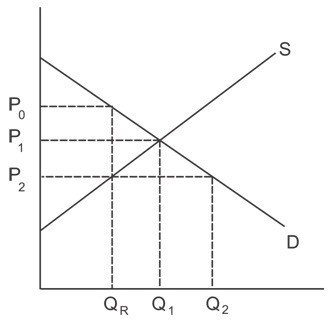

Refer to the graph shown. A quantity restriction of QR will:

A. lower market price to P2. B. maintain a market price of P1. C. raise market price to P0. D. have no effect in the market depicted.