What steps can a bank take to deal with a significant outflow of deposits?

What will be an ideal response?

Banks need to manage their assets so as to reduce exposure to liquidity risk without sacrificing too much profitability. Banks can meet a significant outflow of deposits by drawing down their excess reserves, selling off securities, declining to renew loans, borrowing from other banks and corporations through the federal funds market and repurchase agreements, and borrowing from the Fed through discount loans.

You might also like to view...

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________.

A. Rising; A B. Falling; A; C C. Falling; B: C D. Rising; A; C

The figure above shows the demand and cost curves for a single-price monopoly. The firm will produce ________ units and set a price of ________ per unit

A) 15; $20 B) 10; $20 C) 10; $30 D) None of the above answers is correct.

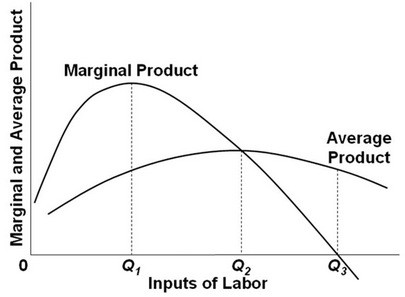

In the above diagram, total product will be at a maximum at:

In the above diagram, total product will be at a maximum at:

A. Q2 units of labor B. Q3 units of labor C. Q1 units of labor D. some point that cannot be determined with the above information.

Output in a Cournot duopoly is at a level between that in perfect competition and monopolistic competition.

Answer the following statement true (T) or false (F)