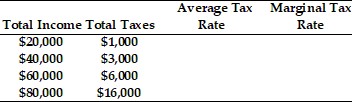

Refer to the information provided in Table 19.7 below to answer the question(s) that follow.

Table 19.7  Refer to Table 19.7. The tax rate structure in this example is

Refer to Table 19.7. The tax rate structure in this example is

A. regressive.

B. marginal.

C. proportional.

D. progressive.

Answer: D

You might also like to view...

Suppose an economy has a balanced federal budget, and a large increase in oil prices plunges the economy into a recession. Tax revenues will ________ and expenditures on transfer payments will ________, resulting in a budget ________

A) increase; increase; surplus B) fall; increase; deficit C) increase; fall; surplus D) fall; fall; deficit

A tax on interest income could be efficient even if it leads to a decrease in savings.

Answer the following statement true (T) or false (F)

Since the mid-1980s, the United States has been a net ________ and a ________ nation

A) borrower; creditor B) lender; creditor C) borrower; debtor D) lender; debtor

Which of the following would cause the equilibrium price of white bread to decrease and the equilibrium quantity of white bread to increase?

A) a decrease in the price of flour B) an increase in the price of rye bread, a substitute for white bread C) an increase in the price of butter, a complement for white bread D) an increase in the price of flour