A family that earns $20,000 a year pays $4,000 a year in payroll taxes. A family that earns $40,000 a year pays $8,000 a year in payroll taxes. The payroll tax is a ________ tax.

A. progressive

B. regressive

C. proportional

D. benefits-received

Answer: C

You might also like to view...

The measurement system used by the U.S. government to estimate national income is

A) the sum of financial transactions, transfer payments and secondhand goods. B) the sum of consumption plus investment expenditures. C) national income accounting. D) the GDP deflator.

The formula for the CPI is

A) (Cost of CPI market basket at base period prices ÷ Cost of CPI market basket at current period prices) × 100. B) (Cost of CPI market basket at current period prices ÷ Cost of CPI market basket at base period prices) × 100. C) (Cost of CPI market basket this year × Cost of CPI market basket at base period prices) × 100. D) (Cost of CPI market basket this year × Cost of CPI market basket at base period prices) ÷ 100. E) (Cost of CPI market basket at current period prices ÷ Cost of CPI market basket at next year's prices) × 100.

Refer to Figure 17-6. If firms and workers have adaptive expectations, an expansionary monetary policy will cause the short-run equilibrium to move from

A) point B to point C. B) point A to point C. C) point B to point A. D) point A to point B. E) point C to point B.

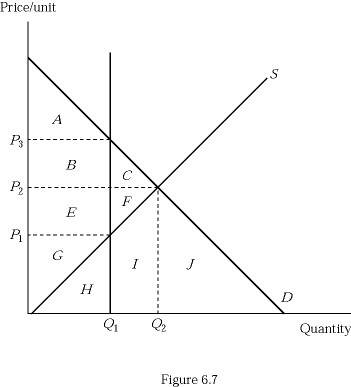

In Figure 6.7 with a quantity constraint of Q1, the dead weight loss is area:

In Figure 6.7 with a quantity constraint of Q1, the dead weight loss is area:

A. A. B. H + I + J. C. C + F. D. G.