Several features distinguish hedge funds from traditional mutual funds, including

A) mutual funds have a minimum investment requirement of $1,000 or more; hedge funds have no minimum investment requirement.

B) hedge funds typically charge investors large fees relative to mutual funds.

C) hedge fund investors need not commit their money for more than a few weeks at a time, explaining why they pay higher fees.

D) hedge funds are significantly less risky relative to mutual funds.

B

You might also like to view...

Suppose you lend $2,500 at 11.5% for 3 years. If the interest is compounded annually, how much interest will you receive in those 3 years?

A. $862.50 B. $965.49 C. $3,362.50 D. $2,465.49

Economic decision making recognizes that

A) all choices have benefits and costs. B) benefits are largely free while costs are not. C) costs are controllable but benefits are not measurable. D) prices do not reflect all information known to managers. E) resources and wants are limited.

A stochastic process {xt: t = 1,2,….} with a finite second moment [E(xt2) <

A. E(xt) is variable, Var(xt) is variable, and for any t, h 1, Cov(xt, xt+h) depends only on ‘h' and not on ‘t'.

B. E(xt) is variable, Var(xt) is variable, and for any t, h 1, Cov(xt, xt+h) depends only on ‘t' and not on h.

C. E(xt) is constant, Var(xt) is constant, and for any t, h 1, Cov(xt, xt+h) depends only on ‘h' and not on ‘t'.

D. E(xt) is constant, Var(xt) is constant, and for any t, h 1, Cov(xt, xt+h) depends only on ‘t' and not on ‘h'.

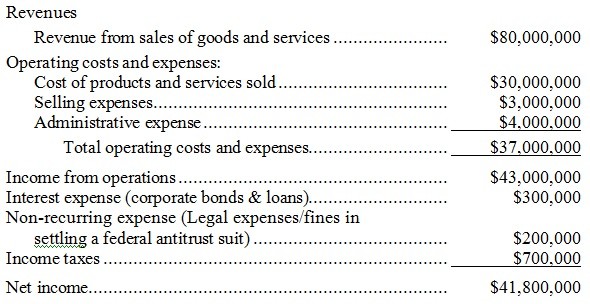

An annual income statement from Quest Realty, Inc. is shown below: During this year of operation, Quest Realty owned and occupied an office building in downtown Indianapolis. For this year, the building could have been leased to other businesses for $2,000,000 in lease income. Quest Realty also owned undeveloped land valued at $15,000,000. Owners of Quest Realty can earn a 14% rate of return annually on funds invested elsewhere.Quest's accounting profit is

During this year of operation, Quest Realty owned and occupied an office building in downtown Indianapolis. For this year, the building could have been leased to other businesses for $2,000,000 in lease income. Quest Realty also owned undeveloped land valued at $15,000,000. Owners of Quest Realty can earn a 14% rate of return annually on funds invested elsewhere.Quest's accounting profit is

A. -$4,100,000 B. $38,200,000 C. $9,360,000 D. $42,300,000 E. none of the above