Explain the accounting for retirement benefits

RETIREMENT BENEFITS

U.S. GAAP and IFRS require firms to recognize the cost of retirement benefits (pensions,

health care, life insurance) as an expense while employees work, not when they receive payments or other benefits during retirement. Employers often contribute cash to a trust, an entity legally separate from the employer, to fund their retirement obligations. The trust invests the funds received to generate a return. Payments to employees come from both the employer's contributions and investment returns. The accounting records of the trust are separate from the accounting records of the employer, and the amounts on the two sets of books usually differ. Two issues in accounting for defined benefit retirement benefits are as follows:

1 . What items in the accounting records of the retirement trust should the employer recognize

in its financial statement?

2 . How quickly should the employer recognize in its accounting records changes in the performance of the investments held by the trust and the funded status of the retirement

obligation of the trust?

U.S. GAAP and IFRS do not permit the employer to prepare consolidated financial statements with the retirement trust. However, the employer must report the net funded status of each defined benefit retirement plan (that is, the fair value of retirement trust assets minus the retirement trust obligation) as either an asset or a liability on its balance sheet. The offsetting credit (for an overfunded plan) or debit (for an underfunded plan) is to Other Comprehensive Income. Notes to the financial statements provide information about investments made by the retirement trust and how trust assets and liabilities changed during a period.

Although an employer must recognize changes in the funded status of a defined benefit

retirement plan on its balance sheet each period, U.S. GAAP and IFRS do not require the

employer to recognize these changes immediately in net income. Changes in the net funded

status of a defined benefit retirement plan because investment performance differs from

expectations, or because of changes in actuarial assumptions, or in the retirement benefit formula, initially affect other comprehensive income. Firms then amortize the amounts in Other Comprehensive Income over the expected period of benefit as an adjustment to retirement plan cost.

One issue in accounting for the cost of retirement benefits is whether firms should defer

and then amortize changes in the funded status of a retirement plan or whether these changes

should affect net income immediately. Those favoring the defer-and-amortize approach argue

that accounting should reflect the long-term perspective of retirement plans and smooth out

the effects on net income of annual deviations related to investment performance, changes

in actuarial assumptions, and changes in the benefit formula. Furthermore, they argue that

users of the financial statements can obtain information about the funded status of a defined

benefit retirement plan by examining the balance sheet and notes to the financial statements.

Those favoring immediate recognition argue that recognizing the effect of these changes in

net income as they occur provides the financial statement user with more timely information

and makes the nature and amount of changes in the funded status in a particular year more

obvious than amortizing changes of several years into a single net amortized amount.

You might also like to view...

Although the ASEAN member countries are geographically close, they have historically been divided in many respects

Indicate whether the statement is true or false

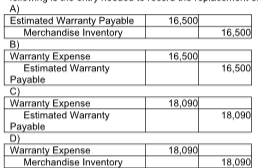

Masterpiece Sales Company offers warranties on all their electronic goods. Warranty expense is estimated at 3% of sales revenue. In 2019, the company had $603,000 in sales. In the same year, Masterpiece Sales replaced defective goods with goods that had a cost of $16,500. Which of the following is the entry needed to record the replacement of the defective goods?

Which of the following is the most accurate comparison of structured and unstructured data?

A) More unstructured data than structured data is created every day. B) More structured data than unstructured data is created every day. C) Computers can organize and understand structured data but not unstructured data. D) Computers can organize and understand unstructured data but not structured data. E) Data mining and analysis has historically focused on unstructured data rather than structured data.

The Fair Labor Standards Act guarantees workers unpaid time off from work for family and medical emergencies and other specified situations

Indicate whether the statement is true or false