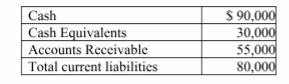

The Metro Construction Company had the following financial data as of December 31, 2018:

Cash and cash equivalents $120,000

Total current liabilities 80,000

a. What is the cash ratio as of December 31, 2018? Show the formula and your computations.

b. Comment on the cash ratio for Metro Construction Company.

a. Cash ratio = (Cash + Cash equivalents)/Total current liabilities

= ($90,000 + $30,000)/$80,000

= 1.5

b. The cash ratio is used to measure a company's ability to meet its short-term obligations. This ratio is the most conservative valuation of liquidity because it only includes cash and cash equivalents. Metro's cash ratio exceeds 1.0. This ratio indicates that the company has a sufficient supply of cash and cash equivalents to pay current liabilities. Since the ratio exceeds one, this may indicate that Metro has an unnecessarily large amount of cash and cash equivalents.

You might also like to view...

A contract that has not been fully performed by the end of a year from the day of its making must be rewritten to continue in force.

Answer the following statement true (T) or false (F)

The Poisson random variable is a discrete random variable with infinitely many possible values

a. True b. False Indicate whether the statement is true or false

Heavy Duty Company, a manufacturer of power tools, decides to offer a rebate of $130 on its 16-inch mid-range chain saw, which currently has a retail price $490

Heavy Duty's marketers estimate that, as a result of the rebate, sales of this model will increase from 60,000 to 80,000 units next year. The profit margin for Heavy Duty before the rebate is $180. Based on the given information, is the decision to give the rebate a wise one? A) No, since costs are $7,800,000 more than benefits. B) No, since costs are $6,800,000 more than benefits. C) Yes, since the benefits are $3,400,000 more than the costs. D) Yes, since the benefits are $7,300,000 more than the costs.

A firm requires an investment of $30,000 and borrows $15,000 at 7%. If the return on equity is 19%, what is the firm's pretax WACC?

A) 13% B) 6.5% C) 15.6% D) 18.2%