Answer the following statement(s) true (T) or false (F)

1. Of two baskets with identical standard deviations, a risk-averse person will prefer the basket with the higher expected value.

2. A stock that is guaranteed to increase in value is risk-free.

3. By definition, a risk preferring person will gamble no matter what the odds.

4. A risk neutral person earning $30,000 per year would likely be willing to pay a year's worth of income for a 50-50 chance at winning $70,000.

5. A risk neutral individual has indifference curves that are identical to the iso-expected lines of a fair gamble.

1. True

2. True

3. False

4. False

5. False

You might also like to view...

Suppose the public increases the level of savings in anticipation of higher future taxes to service the national debt. This is an example of

A) Reaganomics. B) Ricardian equivalence. C) Smithsonian equivalence. D) Monetary equivalence.

Elasticity computations related to demand carry a minus sign to show that the demand curve is negatively sloped

a. True b. False Indicate whether the statement is true or false

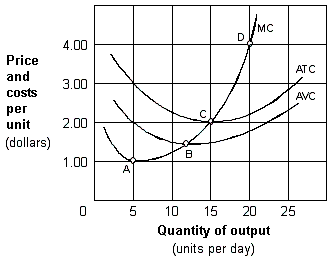

Exhibit 8-3 Cost per unit curves

A. $1.00 per unit. B. $1.50 per unit. C. $2.00 per unit. D. $4.00 per unit.

If an outdoor vendor loses her job when winter weather comes, this individual is

A. structurally unemployed. B. seasonally unemployed. C. cyclically unemployed. D. chronically unemployed.