The inflation tax is an:

A. implicit tax on the holders of cash and the holders of assets specified in nominal terms.

B. implicit tax on the holders of cash and the holders of assets specified in real terms.

C. explicit tax on firms that raise their prices.

D. explicit tax on wealth.

Answer: A

You might also like to view...

The Capper-Volstead Act of 1922 applied the Sherman Anti-Trust Act to farm cooperatives, preventing them from restricting output and fixing prices

Indicate whether the statement is true or false

Barbie is deciding whether to play soccer or go swimming over the next hour. She decides to swim. Economists would conclude that Barbie:

A. is revealing a preference for swimming over soccer. B. will get less utility from swimming during the next hour than playing soccer. C. was unable to play soccer at that time. D. is more skilled at swimming than playing soccer.

A monopolist will operate in the short run if which of the following is above average variable cost?

a. Marginal cost. b. Marginal revenue. c. Price. d. All of these.

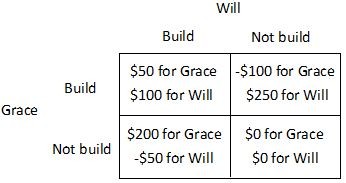

Will and Grace have adjoining unfenced back yards and each has just adopted a new puppy. Will values a fence between their yards at $250 and Grace values a fence between their yards at $200. The cost of building the fence is $300, which will be split equally if they both agree to build the fence. Therefore, their payoff matrix is as follows.  In the Nash equilibrium of this game:

In the Nash equilibrium of this game:

A. Will will build the fence by himself. B. Will and Grace will both build the fence and split the cost. C. no fence will be built. D. the fence will be built, but it is uncertain who will build it.