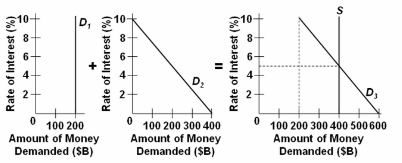

Refer to the given market-for-money diagrams. If the Federal Reserve increased the stock of money, the:

A. S curve would shift leftward and the equilibrium interest rate would rise.

B. S curve would shift rightward and the equilibrium interest rate would fall.

C. D 3 would shift leftward and the equilibrium interest rate would fall.

D. D 3 curve would shift leftward and the equilibrium interest rate would rise.

B. S curve would shift rightward and the equilibrium interest rate would fall.

You might also like to view...

At the current level of output, the marginal social benefit from a slice of pizza is less than the marginal social cost of producing a slice of pizza

Resources will be used more efficiently if ________ slices of pizza are produced and ________ other goods are produced. A) fewer; fewer B) more; fewer C) more; more D) fewer; more

Of the three types of price-discrimination, which yields the greatest profits to the firm?

A) first-degree price discrimination B) third-degree price discrimination C) zero-degree price discrimination D) second-degree price discrimination

If the banking system has $50 billion in excess reserves, and the required reserve ratio is 25 percent, what is the maximum amount by which the money supply can be increased?

a. $250 billion b. $200 billion c. $50 billion d. $25 billion

Which of the following statements about the real loanable funds market is not true?

a. Movements in the real risk-free interest rate cause significant changes in borrowers' willingness and ability to tap the domestic credit market if the demand is highly elastic. b. The more inelastic a nation's supply of real loanable funds, the less sensitive domestic savers, banks, foreigners, and governments are to changes in the real risk-free interest rate. c. Monetary policy is usually stronger in nations with elastic real loanable funds demands. d. Fiscal policy is usually weaker in nations with inelastic loanable funds demands. e. All of the above are true.