Maccarone Corporation manufactures numerous products, one of which is called Tau10. The company has provided the following data about this product:?Unit sales130,000?Selling price per unit$36.00?Variable cost per unit$21.00?Traceable fixed expense$1,690,000Required:a. What net operating income is the company earning now on its sales of Tau10?b. Management is considering decreasing the price of Tau10 by 5%, from $36.00 to $34.20. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 130,000 units to 143,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Tau10 earn at a price of $34.20 if this sales forecast is correct?c. Assuming that the total traceable fixed expense does

not change, if Maccarone decreases the price of Tau10 to $34.20, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $36.00? (Round your answer to the nearest one-tenth of a percent.)

What will be an ideal response?

a.

| ? | Unit sales (a) | 130,000 |

| ? | Selling price per unit | $36.00 |

| ? | Variable cost per unit | 21.00 |

| ? | Contribution margin per unit (b) | $15.00 |

| ? | Total contribution margin (a) x (b) | $1,950,000 |

| ? | Traceable fixed expense | 1,690,000 |

| ? | Net operating income | $260,000 |

b. The profit at the price of $34.20 per unit is computed as follows:

Profit = (P ? V) × Q ? Fixed expenses

Profit = ($34.20 per unit ? $21.00 per unit) × 143,000 units ? $1,690,000

Profit = ($13.20 per unit) × 143,000 units ? $1,690,000

Profit = $1,887,600 ? $1,690,000 = $197,600

c. Profit = (P ? V) × Q ? Fixed expenses

$260,000 = ($34.20 per unit ? $21.00 per unit) × Q ? $1,690,000

$1,950,000 = ($34.20 per unit ? $21.00 per unit) × Q

$1,950,000 = ($13.20 per unit) × Q

Q = $1,950,000 ÷ $13.20 per unit = 147,728 units (rounded up)

Percentage change in unit sales = (147,728 units ? 130,000 units) ÷ 130,000 units = 13.6% (rounded)

You might also like to view...

Martha is walking along a street with her son when he is hit by a passing car just as he steps off the pavement. He dies in his mother's arms, leaving her traumatized. The court hearing the case rules that Martha's son was not responsible for the accident. Martha can sue the person who killed her son to recover damages for ________.

A. the tort of outrage B. breach of the duty of care C. negligent infliction of emotional distress D. transfer of intent

According to Vizio, "The whole goal is to ensure that we have the right product, at the right time and the right price and ________."

A. at the right place B. create customer value that is unmatched in the industry C. deliver it to the right people D. forever rid the world of plugs and wires E. drive a seamless end-to-end value chain

Three different authentication methods can be used with IKE key determination: Public key encryption, symmetric key encryption, and _________

What will be an ideal response?

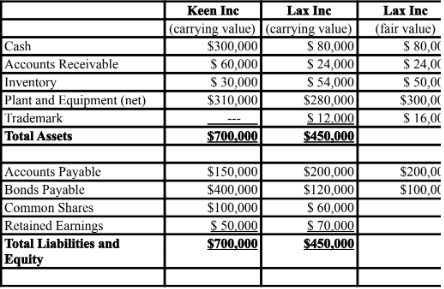

Assuming that Keen Inc. purchases 100% of Lax Inc. for $200,000, prepare the consolidated balance sheet on the date of acquisition under the Entity Theory.

Keen Inc. and Lax Inc. had the following balance sheets on October 31, 2018: