Refer to the information provided in Table 19.4 below to answer the question(s) that follow.Table 19.4Total IncomeTotal Taxes$10,000 $1,000 20,000 2,400 30,000 4,500 40,000 8,000Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $20,000, the average tax rate is

A. 1.2%.

B. 8.3%.

C. 12%.

D. 24%.

Answer: C

You might also like to view...

When the dollar depreciates, the prices of imported inputs

A. fall and aggregate supply shifts outward. B. fall and aggregate supply shifts inward. C. rise and aggregate supply shifts outward. D. rise and aggregate supply shifts inward.

The international equilibrium price is the point at which:

a. the domestic supply curve of one country intersects the domestic demand curve of another. b. the domestic demand and supply curves of a country intersects each other. c. the export supply curve of one country intersects the import demand curve of another. d. the domestic demand of the trading partners become identical. e. the domestic supply of the trading partners become identical.

Granting a pharmaceutical company a patent for a new medicine will lead to (i) a product that is priced higher than it would be without the exclusive rights. (ii) incentives for pharmaceutical companies to invest in research and development. (iii) higher quantities of output than without the patent

a. (i) and (ii) only b. (ii) and (iii) only c. (i) and (iii) only d. (i), (ii), and (iii)

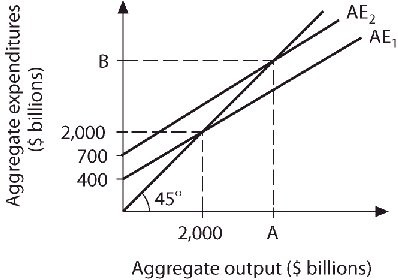

Refer to the information provided in Figure 24.4 below to answer the question(s) that follow. Figure 24.4Refer to Figure 24.4. The value of Point B is

Figure 24.4Refer to Figure 24.4. The value of Point B is

A. $3,000 billion. B. $4,000 billion C. $5,000 billion D. the same as the value of Point A.