Would the maximum loan that a bank can make be different when receiving a discount loan from the Federal Reserve of $1 million versus receiving a checking account deposit of $1 million? Explain why or why not

What will be an ideal response?

They are different. Both increase the reserves at the bank by $1 million, but the bank does not have to hold required reserves against the discount loan because it is not a deposit. The entire $1 million of the discount loan is excess reserves, which the bank can loan out.

You might also like to view...

A good or service or a resource is excludable if

A) it is possible to prevent someone from enjoying its benefits. B) it is not possible to prevent someone from enjoying its benefits. C) its use by one person decreases the quantity available for someone else. D) its use by one person does not decrease the quantity available for someone else.

If the supply of a good is perfectly inelastic, the price elasticity of supply will equal

A) positive infinity. B) one. C) zero. D) none of the above.

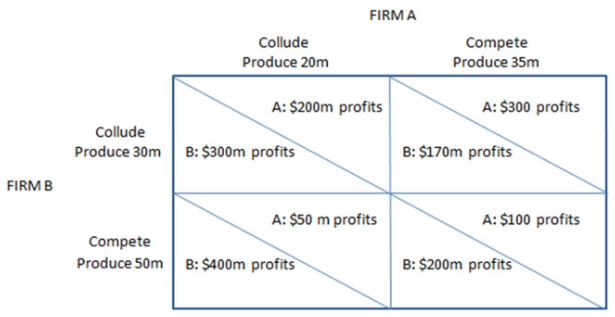

According to the matrix shown, the outcome of the "game" will be:

This prisoner's dilemma game shows the payoffs associated with two firms, A and B, in an oligopoly and their choices to either collude with one another or not.

A. both firms will collude and act like a joint monopolist.

B. both firms will compete.

C. Firm A will compete and Firm B will collude.

D. Firm B will compete and Firm A will collude.

When the firm is able to perfectly price discriminate, each unit is sold at its: a. peak load price

b. reservation price. c. cost price. d. market price.