Explain how "net capital flows" are related to "net foreign investment," "net foreign direct investment," and "net foreign portfolio investment."

What will be an ideal response?

Net capital flows measure the difference between capital inflows and capital outflows. Capital inflows increase when assets flow into the United States from other countries. Capital outflows increase when assets flow from the United States into other countries. Net foreign investment is equal to net foreign direct investment (U.S. investment in facilities in other countries minus foreign investment in U.S. facilities) plus net foreign portfolio investment (U.S. investment in foreign stocks or bonds minus foreign investment in U.S. stocks or bonds). An increase in net foreign direct investment or an increase in foreign portfolio investment will result in an equal decrease in net capital flows. In other words, net capital flows will be equal to the negative of net foreign investment.

You might also like to view...

President Bush lowered income taxes for individuals in 2001. Explain how lower income taxes affect the aggregate demand curve

What will be an ideal response?

Normative economic analysis involves

A) true statements of facts only. B) testable hypotheses by scientists. C) value judgments and opinions. D) purely descriptive statements.

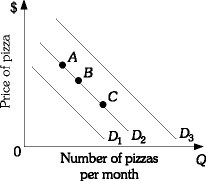

Refer to the information provided in Figure 3.7 below to answer the following question(s). ?Figure 3.7Refer to Figure 3.7. If pizza and beer are complementary goods, an increase in the price of beer will cause a movement from Point B on demand curve D2 to

?Figure 3.7Refer to Figure 3.7. If pizza and beer are complementary goods, an increase in the price of beer will cause a movement from Point B on demand curve D2 to

A. demand curve D1. B. Point C on demand curve D2. C. demand curve D3. D. Point A on demand curve D2.

After browsing his cabinets to see what meals he can make, Ken is deciding whether to make nachos or spaghetti for dinner. If Ken makes spaghetti, we can conclude:

A. Ken doesn't like nachos. B. Ken will get more utility from making spaghetti for dinner than nachos. C. Ken prefers nachos over spaghetti. D. None of these is true.