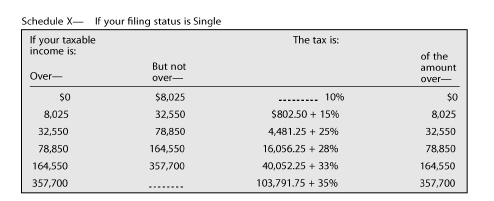

Janine rented an apartment for $900 a month. After a year, she bought a house with a monthly mortgage of $1,250. At the end of the year, she is able to deduct $4,900 in real estate taxes and $8,400 in interest. Janine's taxable income is $42,000. Using the tax schedule below, how much was she able to save on her taxes due to her home ownership?

A. $2,940.00

B. $3,101.25

C. $3,903.75

D. $6,843.75

Answer: A

Mathematics

You might also like to view...

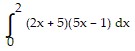

Evaluate the definite integral.

A. 162

B.

C. 40

D.

Mathematics

Multiply.0.7536 × 1000

A. 753.6 B. 75.36 C. 0.7536000 D. 1000.7536

Mathematics

Find an equation of the line. Write the equation using function notation.(4, -27), (-3, 8)

A. f(x) =  x -

x -

B. f(x) = -5x - 7

C. f(x) = 5x - 47

D. y = -  x -

x -

Mathematics

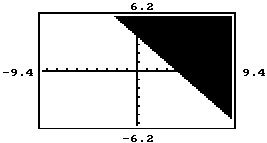

Using the concepts of graphing inequalities, determine the inequality which describes the graph.

A. y ? x + 4 B. y ? x + 4 C. y ? -x + 4 D. y ? -x + 4

Mathematics