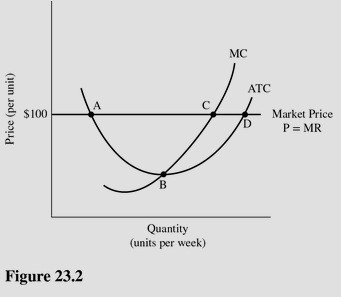

Refer to Figure 23.2 for a perfectly competitive firm. Given the current market price of $100, we expect to see

Refer to Figure 23.2 for a perfectly competitive firm. Given the current market price of $100, we expect to see

A. Firms enter the industry, driving down the market price.

B. Firms exit from the industry, driving up the market price.

C. No change in the number of firms in the industry and no change in the market price.

D. Firms enter the industry, driving up the market price.

Answer: A

You might also like to view...

The figure above shows the housing market in the city of Appleville. A rent ceiling of $650 per month is imposed. With the rent ceiling, what is the maximum black market rent in Appleville?

A) $650 per month B) $700 per month C) $750 per month D) $800 per month

According to the Gordon-Growth model, what will be the percentage change in the value of a stock of a company whose current dividend is $10.00 and whose dividends had been expected to grow by 3% but now are expected to grow by 4% per year?

A) 4.0% B) 17.8% C) 25.0% D) 33.3%

A price floor in a perfectly competitive market

a. is efficient b. is a Pareto improvement c. is effective only if it is set below the equilibrium price d. transfers some surplus from consumers to producers e. transfers some surplus from producers to consumers

The "quantitative easing" policies of the Fed during, and following, the financial crisis of 2008-2009,

a. expanded the reserves available to the banking system, leading to a rapid increase in the M1 money supply as banks used the reserves to extend additional loans. b. reduced the reserves available to the banking system, leading to a sharp reduction in outstanding loans and a decline in the M1 money supply. c. expanded the reserves available to the banking system, but the M1 money supply increased slowly because the banks enlarged their excess reserves. d. reduced the reserves available to the banking system, leading to a substantial increase in outstanding loans and the M1 money supply.