Under the gold standard system, 1 ounce of gold was worth $23 in the United States and worth 15.5 pounds in Great Britain. If the price of gold in Great Britain decreases by 10%, then:

A) the new exchange rate would show approximately 10% depreciation of the dollar.

B) $1 = 1.64 pounds.

C) 1 pound = $1.64.

D) the new exchange rate would show approximately 10% depreciation of the dollar, and 1 pound would be equal to $1.64.

Ans: D) the new exchange rate would show approximately 10% depreciation of the dollar, and 1 pound would be equal to $1.64.

You might also like to view...

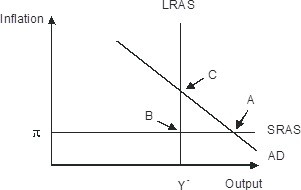

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Say the required reserve ratio is 10 percent. If you pay back a loan of $20,000 a bank had previously made to you, the act of paying back the loan: a. adds $2,000 in bank reserves

b. adds $20,000 in bank reserves. c. eliminates $2,000 in bank reserves. d. eliminates $20,000 in bank reserves.

Monetarists believe

A) Real GDP is not determined by M in the long run. B) velocity is constant. C) the SRAS curve is vertical. D) a and c E) a, b and c

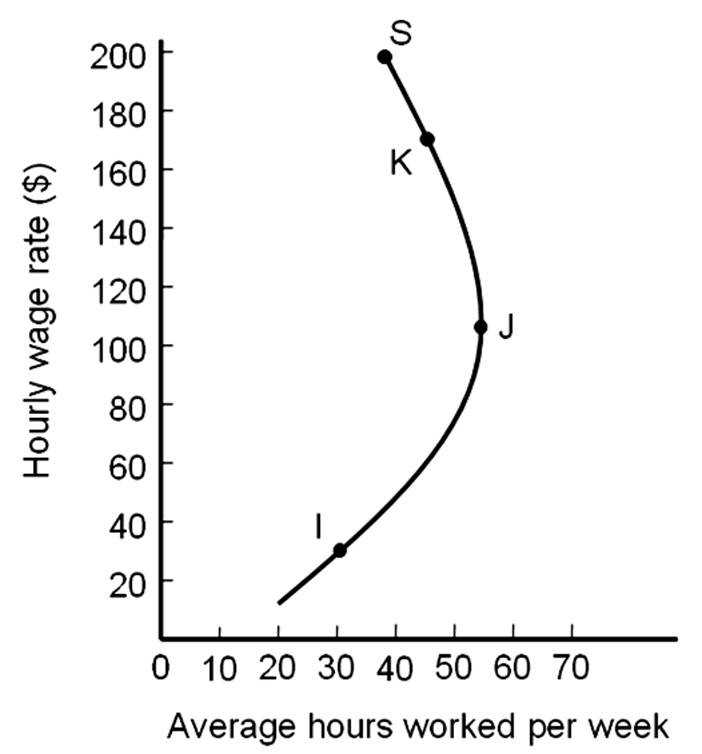

The income effect and the substitution effect offset each other at point

A. I.

B. J.

C. K.

D. S.