If the reserve ratio is 8 percent, then the money multiplier is

a. 12.5.

b. 11.5.

c. 13.5.

d. 8.

a

You might also like to view...

Use the following information on a hypothetical short-run production function to answer questions a-c

Units of Labor/Day 5 6 7 8 9 Units of Output/Day 120 140 155 165 168 The price of labor is $20 per day. Ten units of capital are used each day, regardless of output level. The price of capital is $50 per unit. a. Calculate the marginal and average variable product of each unit of labor input. b. Calculate total, average total, average variable, and marginal costs. c. Can you tell where diminishing marginal returns sets in?

The upward-sloping part of the long-run average total cost curve is a result of: a. economies of scale

b. diseconomies of scale. c. constant returns to scale. d. diminishing marginal returns.

Under a gold standard in which France defined one franc to be worth 1/50th of an ounce of gold and the U.S. defined one dollar to be worth 1/10th of an ounce of gold, then

A. one U.S. dollar would exchange for five French francs. B. the French franc is worth only one-tenth as much as the dollar is worth. C. the U.S. dollar is valued at one-fifth of the French franc. D. on French franc would exchange for ten dollars.

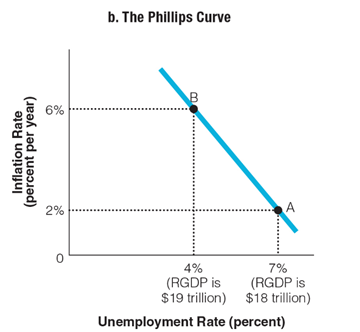

In the graph showing the Phillips curve, a higher inflation rate goes along with ______.

a. a higher unemployment rate

b. an identical unemployment rate

c. a lower unemployment rate

d. an indeterminate unemployment rate