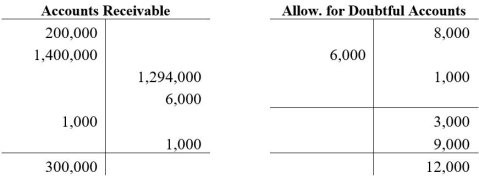

The Lily Company uses the percent of receivables method of accounting for uncollectible accounts receivable, and a perpetual inventory system. As of January 1, its net accounts receivable totaled $192,000 (Accounts Receivable $200,000 less an $8,000 Allowance for Doubtful Accounts). During the current year, the following transactions occurred. 1)Merchandise costing $1,050,000 was sold on account for $1,400,000. 2)The company collected $1,294,000 from customers on account.3)$6,000 of accounts receivable were deemed uncollectible and written off.4)$1,000 of accounts receivable previously written off as uncollectible were recovered.5)At year-end, Lily Company estimates that 4% of its accounts receivable are uncollectible.Prepare journal entries to record these transactions.

What will be an ideal response?

| 1) | Accounts Receivable | ? | 1,400,000 | ? | |

| ? | Sales | ? | ? | ? | 1,400,000 |

| ? | Cost of Goods Sold | ? | 1,050,000 | ? |

| ? | Merchandise Inventory | ? | ? | 1,050,000 |

| 2) | Cash | ? | ? | 1,294,000 | ? |

| ? | Accounts Receivable | ? | ? | 1,294,000 |

| 3) | Allowance for Doubtful Accounts | 6,000 | ? |

| ? | Accounts Receivable | ? | ? | 6,000 |

| 4) | Accounts Receivable | ? | 1,000 | ? |

| ? | Allowance for Doubtful Accounts | ? | 1,000 |

| ? | Cash | ? | ? | 1,000 | ? |

| ? | Accounts Receivable | ? | ? | 1,000 |

| 5) | Bad Debts Expense | ? | 9,000 | ? |

| ? | Allowance for Doubtful Accounts | ? | 9,000 |

You might also like to view...

Ricky invested a lump sum of $25,450 in a mutual fund with an offer price of $25.65. How many shares did he purchase? (Round to the nearest thousandth)

What will be an ideal response?

Briefly define and discuss the six steps of the marketing research process

What will be an ideal response?

The unadjusted trial balance and the adjustment data for Porter Business Institute are given below along with adjusting entry information. What is the impact on net income if these adjustments are not recorded? Show the calculation for net income without the adjustments and net income with the adjustments. Which one gives the most accurate net income? Which accounting principles are being violated if the adjustments are not made? Porter Business InstituteUnadjusted Trial BalanceDecember 31 (in millions)?Cash…………………………………………………. ?$ 58,000??Accounts receivable…………..………………59,000??Prepaid insurance …………………………...12,000??Equipment …………………………………….8,000??Accumulated

depreciation-equipment ……….. ??$ 2,000Buildings………………………………………...57,500??Accumulated depreciation-buildings…………..??17,500Land………………………………….55,000??Unearned rent…………………………………..??16,000Long-term notes payable……………………….??50,000Common stock……………………….??50,000Retained earnings ……………………………….??65,600Tuition fees earned ……………………….??74,000Training fees earned ………………………….??23,400Wages expense ……………………………………...32,000??Utilities expense …………………………….8,000??Property taxes expense …………………………5,000??Interest expense …………………………………….4,000?________Totals ………………………………………..$ 298,500 ?$298,500 Additional information items:a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid. What will be an ideal response?

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

Answer the following statement true (T) or false (F)