Suppose, after undergoing genetic testing, you discover that you have a health condition that could result in the emergence of a disability which would make it impossible for you to continue to work. The probability of this happening is 50%. Currently your expected lifetime earnings are $5,000,000, but if the disability hits, your expected lifetime earnings will consist primarily of income earned from government support programs -- and will not add up to more than $1 million.

a. Suppose your tastes are state-independent and the function  can be used to

can be used to

represent your tastes in the expected utility form. Are you risk averse?

b. What is the highest premium you would pay to get fully insured?

c. What is the equation (in terms of

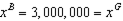

d. Set up the optimization problem that you would solve as you choose among actuarily fair insurance contracts.

e. Solve the optimization problem. What does this imply will be the insurance contract (b,p) that you buy -- where b is the benefit level and p is the insurance premium?

f. Finally, suppose you had state dependent tastes and that the functions

What will be an ideal response?

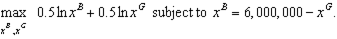

b. The expected utility without insurance is

The highest amount you would pay to get consumption level x that is independent of the state is an amount that would result in

c.

d.

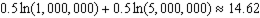

e. The problem solves to

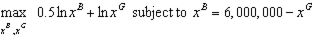

f. The optimization problem becomes

You might also like to view...

The Federal Reserve is a branch of the Treasury Department, and is therefore subject to significant government control

Indicate whether the statement is true or false

In the short-run

A) the aggregate supply curve is upward sloping. B) real GDP is always equal to potential GDP. C) the money wage rate can change. D) the price level does not change.

Which of the following is closest to the future value of a $40,000 deposit earning 3 percent interest annually after 5 years?

A. $41,282 B. $46,021 C. $46,371 D. $41,150

Which of the following is not a public good?

a. a coastal lighthouse b. national defense c. a flood-control levee d. the latest Walt Disney movie