A firm that produces chemical solvents creates some air pollution because of the emissions from its manufacturing facilities. A tax is imposed on the firm, equal to the costs of environmental damage caused by a unit of the emissions. What is the result?

A. Consumers of the chemical solvents will be willing to pay the full amount of the tax, and so the quantity produced will be unaffected.

B. Demand for the chemical solvents will increase.

C. The quantity of chemical solvents produced now will be the efficient amount.

D. Demand for the chemical solvents will decrease.

Answer: C

You might also like to view...

In a perfectly competitive market, the demand curve faced by each firm is:

a. highly inelastic. b. perfectly elastic. c. perfectly inelastic. d. less elastic.

Suppose Fed's purchase of government bonds results in a $120,000 increase in the excess reserves of a particular bank. What would be the applicable reserve requirement for the whole banking system to be able to expand the money supply by $600,000?

a. 10 percent b. 12 percent c. 16 percent d. 20 percent e. 25 percent

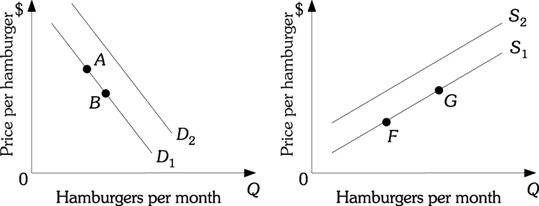

Refer to the information provided in Figure 3.13 below to answer the question(s) that follow. Figure 3.13Refer to Figure 3.13. A decrease in the number of cattle ranchers will cause a movement from

Figure 3.13Refer to Figure 3.13. A decrease in the number of cattle ranchers will cause a movement from

A. Point G to Point F. B. Point A to Point B. C. D2 to D1. D. S1 to S2.

As you move down the production possibility frontier, the absolute value of the marginal rate of transformation

A. increases. B. initially decreases, then increases. C. decreases. D. initially increases, then decreases.