If the demand for cigarettes is inelastic, a per-unit tax on cigarettes will cause the quantity demanded to:

A. rise proportionally more than the increase in price caused by the tax.

B. fall proportionally more than the increase in price caused by the tax.

C. fall proportionally less than the increase in price caused by the tax.

D. rise proportionally less than the increase in price caused by the tax.

Answer: C

You might also like to view...

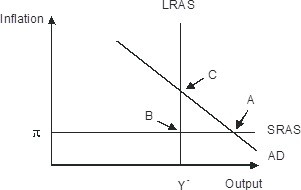

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

If the firm’s marginal physical product is 8, and its handicrafts sell for $70, when a unit of labor costs $150, the firm is operating

A. short of an optimal input point. B. at the optimum input point. C. beyond the optimum input point. D. There isn’t enough information to determine if the input point is optimal.

How do subsidies distort trade patterns and lead to inefficiencies?

Which of the following would be an example of an inferior good?

a. A small pack of cigarettes b. A cheap cut of meat c. A small bottle of milk d. A large bag of cornflakes