The regulation with the lowest authoritative weight is the:

A. Interpretative regulation.

B. Proposed regulation.

C. Legislative regulation.

D. Procedural regulation.

E. None of the choices are correct.

Answer: B

You might also like to view...

One reason for using typical persons as product endorsers is that they are more likely to possess at least some quantity of all five source characteristics

Indicate whether the statement is true or false

Calculate the projected balance of cash at the end of August.

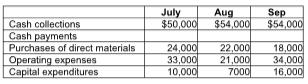

Berman Company is preparing its budget for the third quarter. Cash balance on July 31 was $34,000.

Assume there is no minimum balance of cash required and no borrowing is undertaken. Additional

budgeted data are provided here:

A) $16,000

B) $104,000

C) $45,000

D) $38,000

The bank statement for Raymond Company included a debit memo for a bank service charge of $50.Required:a) Enter this event into the horizontal financial statements model. Indicate dollar amounts of increases and decreases; for accounts that are not affected, indicate NA. For cash flows, show whether they are operating activities (OA), investing activities (IA), or financing activities (FA).Assets=Liab.+Stk. EquityRev.-Exp.=Net Inc.Stmt of Cash Flowsb) Is the bank service charge an asset source, use, or exchange transaction?c) Record in general journal form any necessary entries to the Cash account to adjust it to the true cash balance.

What will be an ideal response?

Monro Inc. uses the accrual method of accounting. Here is a reconciliation of Monro's allowance for bad debts for the current year.Beginning allowance for bad debts?$ 61,150??Actual write-offs of accounts receivable during the year?(80,000)?Addition to allowance? 88,500??Ending allowance for bad debts?$ 69,650???Which of the following statements is true?

A. Bad debt expense per books is $88,500, and the deduction for bad debts is $80,000. B. Bad debt expense per books is $80,000, and the deduction for bad debts is $88,500. C. Bad debt expense per books and the deduction for bad debts is $88,500. D. Bad debt expense per books and the deduction for bad debts is $69,650.