Athena Company provides employee health insurance that costs $5,000 per month. In addition, the company contributes an amount equal to 5% of the employees' $120,000 gross salary to a retirement program. The entry to record the accrued benefits for the month would include a:

A. Debit to Medical Insurance Payable $5,000.

B. Debit to Employee Retirement Program Payable $6,000.

C. Debit to Employee Benefits Expense $11,000.

D. Debit to Payroll Taxes Expense $11,000.

E. Credit to Employee Benefits Expense $11,000.

Answer: C

You might also like to view...

To which situational leadership approaches is the concept of fluidity applicable?

a. path-goal and Hersey/Blanchard b. Hersey/Blanchard and Vroom/Jago c. path-goal and Vroom/Jago d. only path-goal

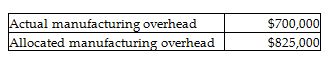

Davie, Inc. used estimated direct labor hours of 240,000 and estimated manufacturing overhead costs of $1,150,000 in establishing its predetermined overhead allocation rate for the year. Actual results showed the following:

What was the number of direct labor hours worked during the year? (Round any intermediate calculations to two decimal places, and your final answer to the nearest whole number.)

A) 146,087 hours

B) 282,857 hours

C) 240,084 hours

D) 172,234 hours

The quoted price for inventory minus discounts plus shipping charges is referred to as the ______________________________

Fill in the blank(s) with correct word

Which ethical leadership principle is described as being the leaders’ duty to treat others as ends in themselves and never as means to an end?

A. serves others B. builds community C. shows justice D. respects others