The Gini ratio in Brazil was over 0.6 in 1990 and fell to 0.5 in 2010. This change means that over this time inequality ________ and the Lorenz curve moved ________ the 45 degree line

A) increased; closer to

B) increased; further away from

C) decreased; closer to

D) decreased; further away from

C

You might also like to view...

An export industry is said to exhibit increasing returns to scale when

(a) a large-scale organization has significant competitive advantages over small-scale activities. (b) labor utilization increases by 50 percent but export output production increases by only 20 percent. (c) its small-scale business activity has significant comparative advantages over large-scale productions. (d) use of capital increases by 10 percent leads to an increase in export production by 10 percent.

The production possibilities curve is: a. a graph that shows the combinations of output which are most profitable to produce

b. a graph that shows the various combinations of output it is possible for an economy to produce given its available resources and technology. c. a graph that shows the various combinations of resources that can be used to produce a given level of output. d. a curve that shows the quantity of output that will be offered for sale at various prices.

You have just bought a used car and drive away satisfied that you’ve made a good deal on the purchase. What would an economist say about your “gain” on the deal?

A. Your gain has clearly meant that the seller lost on the deal. B. The seller has clearly gained, and you have actually lost on the deal. C. Both you and the seller have gained something. D. If your gain is too large, then the deal should be renegotiated. E. If the seller’s loss is too large, then the deal should be renegotiated.

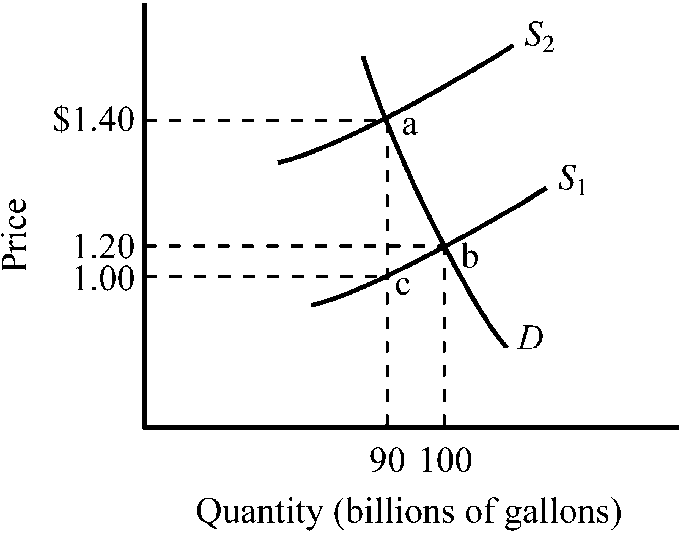

Figure 4-9

Refer to . The market for gasoline was initially in equilibrium at point b. If a $.40 excise tax was imposed,

a.

the supply of gasoline would shift to S2.

b.

the price of gasoline to consumers would increase from $1.20 per gallon to $1.40 per gallon.

c.

the net price received by producers of gasoline would decline from $1.20 per gallon to $1.00 per gallon.

d.

all of the above would occur.