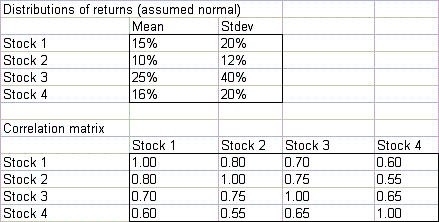

Suppose you have invested 25% of your portfolio in four different stocks. The mean and standard deviation of the annual return on each stock are as shown below. The correlations between the annual returns on the four stocks are also shown below.

What is the probability that your portfolio will lose money during the course of a year?

What will be an ideal response?

There is a 22.34% chance of a negative return

You might also like to view...

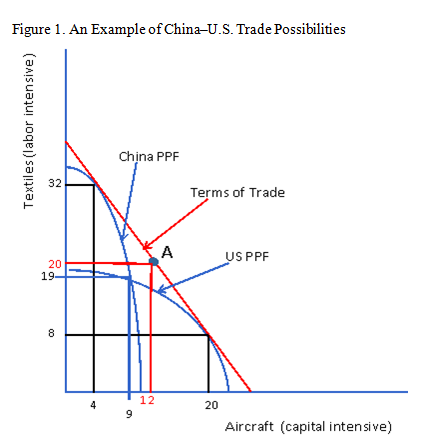

. Considering Figure 1, prior to trade the production of textiles and aircraft for both China and the U.S. are 19 and 9. Which of the following represents the pre-trade situation?

a. China has a comparative advantage in the production of textiles and the U.S. has a comparative advantage in the production of aircraft.

b. China has a comparative advantage in the production of aircraft and the U.S. has a comparative advantage in the production of textiles.

c. China has an absolute advantage in the production of both textiles and aircraft.

d. The U.S. has an absolute advantage in the production of both textiles and aircraft.

Which of the following statements is true concerning hedge accounting?

A. Hedges of foreign currency firm commitments are used for future sales only. B. Hedges of foreign currency firm commitments are used for future purchases only. C. Hedges of foreign currency firm commitments are used for future sales or purchases. D. Hedges of foreign currency firm commitments are used for current sales or purchases. E. Hedges of foreign currency firm commitments are entered into for speculative purposes.

Which theory is based on the observation that factors which meet individuals' need for psychological growth, especially responsibility, job challenge, and achievement must be characteristic of their jobs?

a. McGreagor’s theory X b. Herzberg's two-factor theory c. Maslow’s Hierarchy of needs d. Vroom’s expectancy theory

How did fault-free mass production and the systems manufactured for the defense effort during World War II further the use of statistical methods?