Sinkmaster Corp settled a large lawsuit that caused earnings to be negative for the quarter. This

quarterly loss was the first in 22 years. In addition, the company has a record of 48 consecutive

quarters of dividend payments.

Which of the following is correct?

A) The clientele effect says that investor choice of investment vehicle is independent of dividend

policy and therefore the payment/omission of the dividend is immaterial.

B) The company cannot pay dividends this quarter since the company had no earnings.

C) The company can use cash generated through prior retention of earnings, or borrowed funds

to pay the dividend.

D) The company can omit the dividend; shareholders are always understanding about the

riskiness of business.

C

You might also like to view...

Plesco Corporation acquired 80 percent of Slesco Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Plesco received $350,000 from Slesco for equipment Plesco had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.Based on the preceding information, in the preparation of the 20X8 consolidated financial statements, equipment will be:

A. debited for $25,000. B. credited for $70,000. C. debited for $50,000. D. debited for $40,000.

Explain how luxury brands can benefit during an economic recession from having lower-priced brands or sub-brands in their portfolio

What will be an ideal response?

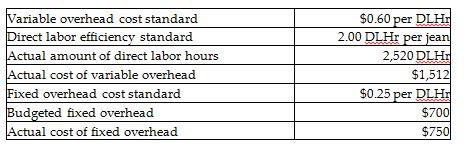

The fixed overhead volume variance measures how fixed overhead is allocated when actual volume is not equal to budgeted volume. The variance measures the difference between the budgeted fixed overhead costs and the amount of fixed overhead costs allocated to the actual output.

Calculate the following variances:

a. Variable overhead cost variance

b. Variable overhead efficiency variance

c. Total variable overhead variance

d. Fixed overhead cost variance

e. Fixed overhead volume variance

f. Total fixed overhead variance

A local distributor for a Belgian chocolate manufacturer expects to sell 12,000 cases of chocolate truffles next year. The annual holding costs for the truffles are $16 per case per year. The ordering cost is $60 per order. The distributor operates 320 days a year. Then the EOQ is ______.

A. 200 B. 300 C. 400 D. 500