From a Keynesian point of view, which is more likely to cause a recession: aggregate demand or aggregate supply. Why?

What will be an ideal response?

Aggregate demand is more likely to cause a recession. This is because the aggregate demand curve is affected by consumption, investment, government spending, and exports and imports. Thus, if businesses were to stop expanding, or investing, aggregate demand will fall, therefore resulting in a recession. Another example would be a decrease in consumption, and this could be due to a lack of confidence from consumers.

You might also like to view...

The advantages of the U-Form of firm organization is

a. workers develop a high degree of functional expertise b. information can be easily shared between similarly trained employees within units c. evaluating employees is easier because managers typically are similarly trained d. all of the above

A strategy that is best for a player regardless of the strategy of the other player is called a(n)

a. subsistence strategy b. determinant strategy c. dominant strategy d. independent strategy e. autonomous strategy

The Herfindahl-Hirschman Index measures:

A. the degree of concentration in a market. B. the percentage of market share held by the four largest firms in a market. C. the percentage of market share held by the largest firm in a market. D. the market share held by the largest firm in a market divided by the market share held by all other firms in the market.

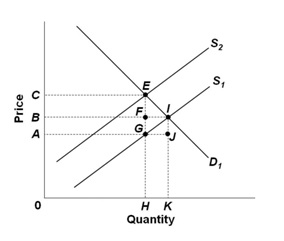

The graph below represents the market for a product where D1 and S1 show the initial supply and demand curves, and supply shifts to S2 due to a sales tax. The government's tax revenue is represented by area:

A. FIJG

B. ACEG

C. BCEF

D. ABFG