During the 1980s, the top marginal tax rate on personal income was reduced from 70 percent to less than 40 percent and it has remained below 40 percent since that time. In recent years, the share of the personal income tax collected from the top one-half of one percent of earners has

a. fallen sharply from the level of years prior to 1981.

b. increased sharply during the Clinton administration, but declined substantially during the administration of George W. Bush.

c. been virtually unchanged from the level of years prior to 1981.

d. increased substantially from the level of years prior to 1981.

D

You might also like to view...

A surplus is said to exist when, at prevailing prices,

A) demand is greater than supply. B) quantity supplied is greater than quantity demanded. C) scarcity is eliminated. D) supply and demand are in harmonic equilibrium.

If there is a "long and variable time lag" between when a change in monetary policy is instituted and when it impacts aggregate demand and output, this will

What will be an ideal response?

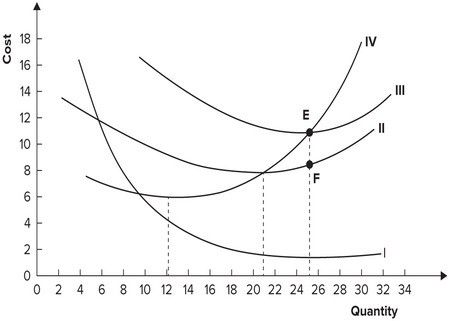

The following graph shows average fixed costs, average variable costs, average total costs, and marginal costs of production. Average variable cost is minimized when output equals:

Average variable cost is minimized when output equals:

A. 21 units. B. 25 units. C. 12 units. D. 6 units.

Sam is a musician who is out of work because electronic equipment replaced live musicians. This is an example of:

A. frictional unemployment. B. cyclical unemployment. C. structural unemployment. D. involuntary unemployment.