The UCC applies to a mixed sale:

A) If the sale of the goods is the predominant part of the transaction.

B) Only if the contract provides that the UCC applies.

C) Whenever a sale of goods is a part of the transaction.

D) Only if there is no service involved.

A

You might also like to view...

Betty Crocker cake mixes using Hershey syrup in its cake mixes and "Lunchables" lunch combinations with Taco Bell tacos are examples of what special type of branding?

A) family branding B) ingredient co-branding C) co-branding D) generic-branding E) individual branding

In general, personal selling is used more with complex, expensive, and risky goods and in markets with fewer and larger sellers

Indicate whether the statement is true or false

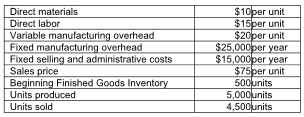

a) Compute Cinnabar's unit product cost under absorption costing and variable costing. b) Prepare income statements for Cinnabar using absorption costing and variable costing. c) Calculate the balance in Finished Goods Inventory using absorption costing and variable costing. Assume that the production level, costs, and sales prices were the same in the previous year.

Cinnabar, Inc. has provided the following data for the year:

Which of the following is not correct regarding the provisions of IAS No. 8 on accounting changes and error corrections?

a. IAS No. 8 requires that results from prior periods be presented for all changes in accounting principles. b. IAS No. 8 allows a change in accounting principle to be accounted for by reflecting the cumulative effect of the change in the income of the current period without restating prior-period results. c. Under IAS No. 8, the recommended approach for a change in accounting principle is that results from prior periods should be restated. d. IAS No. 8 requires a change in accounting estimate to be reflected in the current and future periods.