Which of the following statements is correct?

A. If a 10-year, $1,000 par value bond is issued at a coupon rate of 10 percent and if its market yield is 5 percent, the issuer will purchase bonds in the financial markets because their prices will be less than the par value.

B. If a 10-year, $1,000 par value bond is issued at a coupon rate of 10 percent and if its market yield is 5 percent, the bond's maturity value would be more than its par value.

C. If a 10-year, $1,000 par value bond is issued at a coupon rate of 10 percent and if its market yield is 5 percent, the bond will mature in 15 years and not in 10 years.

D. If a 10-year, $1,000 par value bond is issued at a coupon rate of 10 percent and if its market yield is 5 percent, the bond will sell at a premium.

E. If a 10-year, $1,000 par value bond is issued at a coupon rate of 10 percent and if its market yield is 5 percent, the bond's coupon rate would decrease from 10 percent to 5 percent.

Answer: D

You might also like to view...

Why does NAFTA create a free trade area as opposed to a customs union or a common market? Explain the difference by giving examples

What will be an ideal response?

If a company purchases $3,200 worth of inventory with terms of 3/10, n/30 on March 3 and pays March 12, then the amount paid to the seller would be

a. $96 b. $3,104 c. $3,200 d. None of these choices

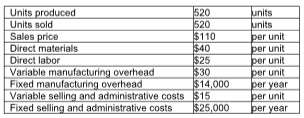

What is the unit product cost using variable costing?

Sequoyah, Inc. reports the following information:

A) $110

B) $92

C) $95

D) $15

The sum of net income and other comprehensive income is/are:

a. Comprehensive Net Income b. Comprehensive Income c. Comprehensive Retained Earnings d. Net Income after comprehensive income items e. none of the above