Hui pays self-employment tax on her sole proprietorship income, supplemental Medicare surtaxes on excess wages and self-employment income (the .09% tax), and supplemental Medicare taxes on investment income (the 3.8% tax). Which of the following statements is correct regarding the deductibility of these taxes?

A) All three of the taxes are deductible as itemized deductions.

B) One-half of the self-employment tax is deductible for AGI, and the .09% and 3.8% taxes are itemized deductions.

C) None of the taxes are allowed as a deduction.

D) One-half of the self-employment tax is deductible for AGI, but the .09% and 3.8% taxes are not allowed as deductions.

D) One-half of the self-employment tax is deductible for AGI, but the .09% and 3.8% taxes are not allowed as deductions.

The two supplemental Medicare taxes are not deductible at all, but one-half of the self-employment tax is allowed as a deduction for AGI.

You might also like to view...

Check 21 requires banks to change their current check-collection practices

Indicate whether the statement is true or false

USA Transport Company uses a mark associated with its name to distinguish its services from those of other transport firms. The mark is

A. a certification mark. B. a collective mark. C. a service mark. D. trade dress.

Which of the following U.S. businesses would be most likely to pursue a foreign licensing agreement?

A) a chain of doughnut shops B) a provider of home security C) a pest removal company D) an industrial window washer E) a skateboard manufacturer

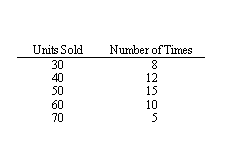

Suppose that the following random numbers were obtained using Excel: 0.12 0.96 0.53 0.80 0.95 0.10 0.40 0.45 0.77 0.29 Use these random numbers to simulate 10 days of sales.

For the past 50 days, daily sales of laundry detergent in a large grocery store have been recorded (to the nearest 10).