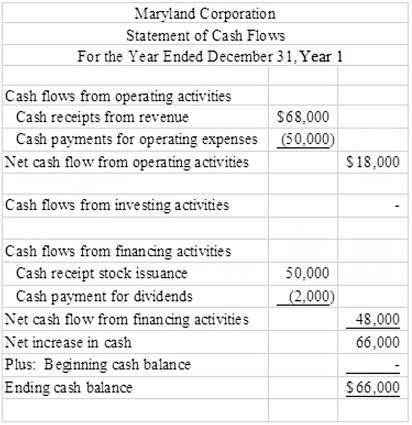

The Maryland Corporation was started on January 1, Year 1, with the issuance of $50,000 of stock. During Year 1, the company provided $75,000 of services on account and collected $68,000 of that amount. Maryland incurred $63,000 of expenses, and paid $50,000 of that amount during Year 1. On December 31, Year 1, Maryland paid investors a $2,000 cash dividend and accrued $4,000 of salary expense.Required:1) Determine the net income for year ended December 31, Year 1.2) Prepare Maryland Corporation's Statement of Cash Flows for the year ended December 31, Year 1.3) Determine the balance in Maryland's Retained Earnings account as of December 31, Year 1.

What will be an ideal response?

1) $8,000

2)

3) Ending retained earnings = Beginning retained earnings of $0 + Net income of $8,000 net income ? Dividends of $2,000 = $6,000

Feedback: 1) Net income = $75,000 ? 63,000 ? 4,000 = $8,000

3) Ending retained earnings = Beginning retained earnings of $0 + Net income of $8,000 net income ? Dividends of $2,000 = $6,000

You might also like to view...

Normally, a duty to pay the agent is implied unless special circumstances or the relationship of the parties suggests that a gratuitous agency was intended.

Answer the following statement true (T) or false (F)

In the confidence interval formula for sample size, the symbol e represents:

A) efficiency of the sample (desired accuracy given the cost) B) sample frame error C) acceptable error (desired accuracy level) D) elasticity E) none of the above; the formula has no e

Which of the following is an example of a demonstration technique?

A. Shock approach B. Complimentary approach C. Premium approach D. Curiosity approach E. Product approach

Using either the FIFO and LIFO cost flow assumption will result in the same cost of goods sold when

a. the number of units in beginning and ending inventory are the same. b. two consecutive years are combined. c. the prices of the goods do not change. d. lower-of-cost-or-market is applied. e. none of the above