The required return for Williamson Heating's stock is 12%, and the stock sells for $40 per share. The firm just paid a dividend of $1.00, and the dividend is expected to grow by 30% per year for the next 4 years, so D4 = $1.00(1.30)4 = $2.8561. After t = 4, the dividend is expected to grow at a constant rate of X% per year forever. What is the stock's expected constant growth rate after t = 4, i.e., what is X?

A. 5.17%

B. 5.44%

C. 5.72%

D. 6.02%

E. 6.34%

Answer: E

You might also like to view...

Britney likes to use coupons and tends to purchase whichever brand of food has the best coupon offer. Britney is which type of consumer?

A) promotion prone B) brand loyal C) price sensitive D) shopper prone

Developing a question's precise wording is not easy. A single word can make a difference in how study participants respond to a question

Indicate whether the statement is true or false

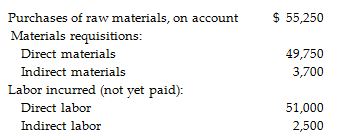

Manufacturing reports the following data for the month:

Journalize the entries relating to materials and labor. Omit explanations.

All of the following should be included in a proposal document EXCEPT:

A. product prices. B. testimonials. C. solutions to specific problems. D. criteria for success. E. data and statistics.