Which of the following statements is CORRECT?

A. The slope of the Security Market Line is beta.

B. Any stock with a negative beta must in theory have a negative required rate of return, provided rRF is positive.

C. If a stock's beta doubles, its required rate of return must also double.

D. If a stock's returns are negatively correlated with returns on most other stocks, the stock's beta will be negative.

E. If a stock has a beta of to 1.0, its required rate of return will be unaffected by changes in the market risk premium.

Answer: D

You might also like to view...

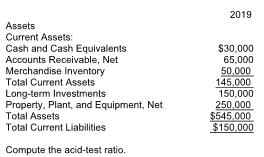

Extracts from the balance sheet of Detroit, Inc. are as follows:

Unrealized gains and losses are reported as other comprehensive income items until the related securities are sold, then the gains and losses become realized and are included in determining net income

Indicate whether the statement is true or false

Persuasion is traditionally a ______ process.

a. step-by-step process b. one-step process c. two-step process d. continuous flux

Discuss and exemplify what the objectives of a poster presentation can be.

What will be an ideal response?