Suppose a Treasury bond will mature in 4 years. If the bond pays a coupon of $200 per year and will make a final par value payment of $5,000 at maturity, what is its price if the relevant market interest rate is 3%?

A) $5,185.85

B) $5,304.26

C) $5,743.42

D) $6,011.82

A

You might also like to view...

When considering the demand for money curve, the interest rate

A) is the price of holding money. B) varies negatively with the transactions demand for money. C) will have a positive relationship with the quantity of money demanded. D) is independent of the opportunity cost of money.

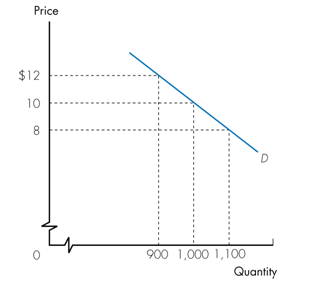

Refer to the graph below representing the market demand curve for a monopolist’s output. Which of the following quantities shown on the graph should the monopolist produce if it wishes to maximize its total revenue?

a. 900

b. 1,000

c. 1,100

d. Any of the above because total revenue does not change with a change in production.

Financial intermediaries increase the probability of a risky venture being funded by concentrating the risk among a few investors.

Answer the following statement true (T) or false (F)

When a price ceiling which had been set below equilibrium price is removed, what happens next?

A. quantity supplied rises B. quantity demanded rises C. supply rises D. demand rises