If the marginal propensity to consume (MPC) is 0.50, the value of the spending multiplier is:

a. 5.

b. 1.

c. 2.

d. 5.

c

You might also like to view...

The figure above illustrates the gasoline market. There is no external benefit from gasoline. If a tax on gasoline is imposed as shown in the figure, then the total tax revenue earned by the government equals

A) $24 million. B) $16 million. C) $8 million. D) more than $24 million. E) less than $8 million.

The level of crowding out associated with a tax cut will be smaller if the tax change has a supply-side effect than it will be if it only has a demand-side effect

Indicate whether the statement is true or false

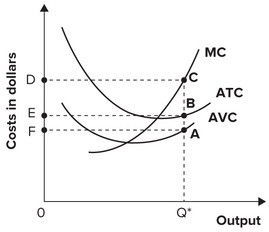

Refer to the graph shown. The line segment that represents average total costs of producing Q* is:

A. BQ*. B. CQ*. C. AQ*. D. AB.

Why do/should we care that federal expenditures are becoming an increasingly larger portion of GDP?

What will be an ideal response?